Grid Battery Metals Inc. (OTCQB: EVKRF) may be an under-the-radar metals play to most investors but know this- they are starting to earn appreciable attention from those wanting exposure to early-stage exploration companies that have the right assets at the right time to seize potentially massive revenue-generating opportunities. That attention is evidenced by EVKRF shares soaring by over 124% since June, closing at $0.08 on Friday—a minor pullback from the 52-week peak in July. Nevertheless, a certain degree of profit-taking is unsurprising; the more important consideration for investors is the trend, which, in EVKRF’s case, remains bullish.

Plenty supports the recent move higher. Chief among them is that this Canadian-based exploration company, despite its nanocap size, has positioned itself well to transform into a valued battery metals supplier for the booming green energy sector. That includes the EV space and energy storage companies needing the lithium and nickel Grid Battery Metals intends to excavate from its compelling assets in the United States and Canada. But there’s more to EVKRF than having excellent assets. Grid Battery Metals’ priorities align with the core principles of the sectors they serve, including reducing carbon footprint, adopting environmentally conscious exploration practices, and adhering to a streamlined exploration approach that separates them from competitors still using archaic and ecologically harmful exploration and development practices and processes.

Retail investors aren’t the only ones tuning in to the EVKRF story. Accredited investors are as well. This was evident as EVKRF successfully concluded a private placement in June, raising gross proceeds of CAD $3 million. The resultant net proceeds from the transaction added to an already impressive nanocap balance sheet, with the company reporting in a recent SEC filing that its treasury, including marketable securities and cash, holds CAD $4.38 million—an amount anticipated to be more than sufficient to advance exploration initiatives throughout the remainder of this year.

Grid Battery Targets Soaring Demand For Battery Metals

From an investor’s perspective, that’s good to know. Being able to tap into the soaring demand for battery metals from multiple sectors besides EVs, including electronics and energy storage fields, with minimal dilution, is generally rewarded by market investors. Holding that position is a likely reason for the rally in EVKRF stock. Another is that investors recognize the value inherent to Grid Battery Metals’ asset portfolio, noting they are exploring the world’s most mining-friendly jurisdictions that have proven to give up appreciable underground assets. While those areas have provided plenty trying to meet demand from just the EV sector, they need to supply lots more to keep pace with market needs.

Especially lithium and nickel, which are vital to powering the EV sector. After all, without batteries to run companies’ vehicles, they are nothing more than shiny showroom pieces. But don’t expect that to be the case. Companies like Tesla (NASDAQ: TSLA), Ford (NYSE: F), and General Motors (NYSE: GM) won’t let themselves get sidelined from lacking batteries for their cars.

Instead, to protect the billions invested in developing the vehicles themselves, they’ll do whatever it takes to secure an ample supply of lithium and nickel for their battery needs. Tesla CEO Elon Musk has already publicly said his intent to explore lithium on its own to secure the essential ingredient for its batteries. But he doesn’t need to.

Partnering with companies already in advanced stages of exploration can be a more efficient and expeditious way of getting what his company needs. That reality, which can come from many other companies, puts EVKRF in an enviable position. Remember, proven assets underground are still immensely valuable. In other words, Grid Battery Metals doesn’t necessarily need to excavate the assets; sitting on top of them is enough to drive share prices potentially exponentially higher. And not only from interested companies.

Grid Battery could get help to advance from the exploration to development stage from recent legislation providing billions in support to companies promoting domestic production for assets needed to fuel green energy initiatives. That includes all of the battery metals. Incidentally, lithium is one of the most essential elements for national security, adding to the Grid Battery Metals value proposition from its potential to earn non-dilutive funding to expand exploration and development operations.

Demand For Nickel Expected To Exponentially Increase

Nickel is equally valuable in most respects. Grid Battery also has its attention there, aligned with automakers shifting towards using higher nickel chemistries in EV batteries to achieve a more sustainable energy delivery solution. While nickel traditionally found its primary application in stainless steel production, its significance has grown significantly in the context of EV batteries from its contribution to higher energy density, cost-effective storage, and extended driving ranges. All three of those measures speak for themselves, with the common element being nickel is essential to advancing new generations of electric mobility.

Keep in mind that the number of passenger vehicles on the road utilizing lithium-ion batteries is projected to reach 10% by 2025. By 2050, it’s expected to explode higher to 58%. Companies already positioned to serve that growth, like Grid Battery, should do better than others. And that demand isn’t expected to diminish any time soon. Instead, the value inherent to lithium-ion battery packs has only heightened their appeal to manufacturers. However, that enthusiasm is tempered by questioning reliable production and delivery of lithium supply from suppliers to meet their demands. Nickel, as well. Demand for it is forecast to increase by 3.7x by 2050 compared to 2019. Best said, there is no soft spot in the revenue-generating opportunities Grid Battery can seize.

Of course, Grid Battery needs the right assets to capitalize on these market opportunities. They have them. Grid Battery is advancing multiple projects in mining-friendly jurisdictions in Nevada and British Columbia, Canada.

Lithium Projects In Mining-Friendly Nevada

Nevada is ranked as the 3rd best global mining jurisdiction and is ideally positioned to cater to domestic and Asian market demand. It’s home to the renowned Tesla Gigafactory, which produces lithium-ion batteries for its vehicles and energy storage solutions. The Gigafactory’s design centers on achieving net-zero energy consumption, predominantly through solar power. By mid-2018, the factory was the highest-volume battery plant globally. But being in Nevada is more than about Tesla. It’s an excellent place to be for Grid Battery.

Lithium production in Nevada dates back to 1966 at the Silver Peak Mine, leading the state to develop the most extensive mining program in the US, holding 49% of the Bureau of Land Management’s active mining claims. Nevada demonstrates a clear commitment overall to efficient mining and reclamation practices. It’s made it an excellent place for Grid Battery to devote resources and, likely, money well spent.

Its Texas Spring Property consists of mineral lode claims in Elko County, Nevada, with early exploration revealing a lithium clay deposit within volcanic tuff and tuffaceous sediments of the Humbolt Formation. It’s located next to other proven claims, including near the southern boundary of the Nevada North Lithium Project owned by Surge Battery Metals Inc. (OTC Pink: NILIF). Initial drilling projects by Surge have identified lithium-rich clay deposits with noteworthy mineralization. The Texas Spring project contains 34 full and 30 partial lode claims, showing significant potential to serve demand. Grid Battery entered into a Purchase and Sale Agreement to acquire Texas Springs Property in Nevada from Springfield Land Limited Liability on June 23, 2023, with consideration made by issuing eight million fully paid and non-assessable common shares. It officially closed the deal on July 13, 2023.

Another asset in Nevada is its Clayton Valley project, with claims adjacent to Albemarle Corporation’s (NYSE: ALB) Silver Peak Lithium Project. That location matters, noting that Albemarle hosts the sole operating lithium mine in North America. The lithium reserves in Clayton Valley exist in underground aquifers as briny groundwater and in montmorillonite clays with abundant lithium content. Commencing exploration in 2021, Grid Battery is focused on data from rock and soil sampling, trenching, and drilling programs, with concepts for a secondary lithium trap in the works. Grid Battery has noted the property has excellent potential to host Lithium brine deposits in favorable geologic horizons within the basin fill. Another possible target is lithium-enriched clay within the fill package and potentially in previous high stands of the playa. Historical data supports optimism.

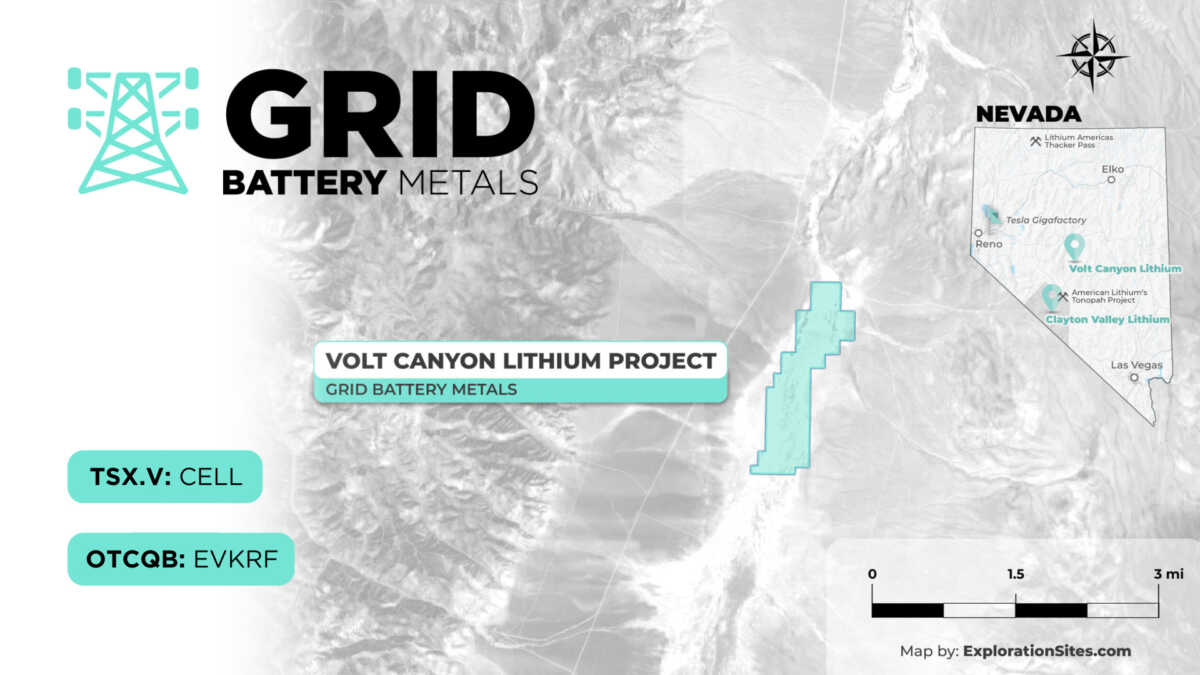

Also in Nevada is Grid Battery’s Volt Canyon Project, a wholly owned asset measured as a 635-hectare plot of alluvial sediments and clays positioned 122 km northeast of Tonopah, Nevada. In the regional NURE data, surface samples from this area indicated lithium concentrations up to 108 ppm Li. The lithium deposit is believed to share similarities with the clay deposits found in Clayton Valley, and importantly, the location has excellent accessibility, enabling exploration and exploitation throughout the year.

Additional assets show equal promise.

Grid Nickel Group Project In BC

Those include projects near FPX Nickel Corp.’s (OTCQB: FPOCF) Decar Project, which recently established its potentially carbon-neutral Baptiste deposit as one of the world’s most robust large-scale nickel ventures. There, Grid Battery’s Grid Nickel Group property shares geological similarities with FPX’s Decar Project, featuring nickel, cobalt, and chromium. The claim also contains nickel as Awaruite, initially discovered in the region in 1983.

The exploration strategy at this spot comprises several components. A Spring 2021 exploration program involved rock and soil sampling, trenching, and drill programs. From that, the company is evaluating the next steps, with contributions in that direction from reviewing historical data from systematic ground-based exploration on the property between 1987 and 2012, under the guidance of esteemed geologist Ursula Mowat. Furthermore, future plans will be directed from insights inherent to a comprehensive analysis from Geoscience BC’s QUEST-West project (2008-2009)., which evaluated a spectrum of activities, including geophysical surveys, stream sediment re-analyses, and data compilation.

Notably, FPX has invested over $25 million in its Decar Project. That supports the premise that they like what they see, which is potentially excellent news for Grid Battery, noting that its property is partially underlain by rocks like those hosting the Decar project. Exploiting its expected share of value again comes from Grid Battery exploring in mining-friendly locations. British Columbia is ideal, offering vast mineral discovery potentials, a proficient workforce, and dedicated resources for exploration and development. In fact, Canada ranked as the world’s top overall mining destination by mining.com in 2023, hosting the world’s largest concentration of exploration companies and mining professionals.

Notably, Awaruite, a natural nickel-iron alloy, was initially found in central British Columbia in 1983. Awaruite has multiple valuable qualities in the EV industry. First, it contains little to no sulfides and does not generate much acid mine drainage. It also does not require chemical reagents or acid leaching for processing, and its waste rock even has the capacity to absorb carbon. Finding that asset could add another catalyst driving growth.

A 124% Rally Expected To Continue

Combining the sum of its parts, Grid Battery Metals stock may expose a disconnect from assets too wide to ignore. That assumption is warranted. Remember, Grid Battery has compelling projects near historically proven locations, the cash to explore, and a management team capable of exploiting asset value to create shareholder value. Furthermore, exploring mineral-rich claims in Nevada and British Columbia, coupled with its management team’s experience in mineral exploration and development, Grid Battery Metals appears better positioned than ever to capitalize on and maximize project intent.

In other words, factoring in Grid Battery’s low overhead mission to exploit assets, added potential from a property package that could include mining awaruite (nickel-iron alloy) that is vital to manufacturing environmentally-friendly EV batteries, and expectations for nickel and lithium demand to soar as consumers adopt EV products, EVKRF stock at current levels presents a value proposition whose window of opportunity could close sooner than later. The investor attention it’s getting certainly supports that presumption.

Disclaimers: Shore Thing Media, LLC. (STM) is responsible for the production and distribution of this content. STM is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. Shore Thing Media, LLC. has been compensated up to three-thousand-five-hundred-dollars cash via wire transfer to produce and syndicate content for Grid Battery Metals Inc. for a period of two weeks ending on September 2, 2023. Please read the full disclaimer at https://primetimeprofiles.com/disclaimer/ for important information about this content.

As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website. Contributors reserve the right, but are not obligated to, submit articles for fact-checking prior to publication. Contributors are under no obligation to accept revisions when not factually supported. Furthermore, because contributors are compensated, readers and viewers of this content should always assume that content provided shows only the positive side of companies, and rarely, if ever, highlights the risks associated with investment. Thus, readers and viewers should accept the content as an advertorial that highlights only the best features of a company. Never take opinion, articles presented, or content provided as a sole reason to invest in any featured company. Investors must always perform their own due diligence prior to investing in any publicly traded company and understand the risks involved, including losing their entire investment. The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.