Alset Capital Inc. (TSXV: KSUM, OTC: ALSCF, FSE: 1R60)

This article is brought to you by Primetime Profiles. Join our FREE mailing list for subscriber-exclusive updates:

Alset Capital Inc. Empowering AI Through Strategic Investment

Alset Capital Inc.’s (TSXV: KSUM) (FSE:1R60, WKN: A3ESVQ) (OTC Other: ALSCF) mission is to drive significant shareholder value through the acquisition and development of AI assets. Alset aims to position its investment portfolio to become the leading publicly listed owner of AI computing infrastructure. Accelerating that mission, Alset announced its successful listing on the Frankfurt Stock Exchange (the “FSE”) under the trading symbol “1R60”, WKN: A3ESVQ, ISIN: CA02115L2003, and to the OTC market (OTC: ALSCF), which significantly expands its reach and potential shareholder base to the European and U.S. markets.

The inclusions create a market beyond the one made on the Toronto Stock Exchange Venture in Canada and, as importantly, will help accelerate its global expansion strategy and give access to international capital markets. Moreover, the combined listings with the world’s largest trading centers for securities provide Alset with enhanced liquidity and exposure to global investors, reinforcing its market presence.

The listing strategy and the exposure from it are working. Interest in Alset Capital is growing, resulting from its intrinsic strength to become a key player and contributor to an Artificial Intelligence (AI) and cloud computing sector that, despite its popularity, is still in its early stages of development. Listening to analysts speak about Tesla (NASDAQ: TSLA), NVIDIA (NASDAQ: NVDA), and Advanced Micro Devices (NASDAQ: AMD), all part of the Magnificent Seven, that assessment makes sense.

After all, harnessing all the potential power of AI may be a never-ending mission, and with it, ushering in a generational shift in how technology is used to produce, grow, manufacture, and create a better quality of life for global populations.

Alset Capital Leverages Key AI-Sector Assets

Alset Capital’s mission is not just about financial gains, but also about leveling the playing field for people and governments. The company aims to democratize access to high-performance AI computing, which can assist them from a logistical, financial, and productivity perspective. This intention puts Alset in the right place at the right time, considering that in the dynamic landscape of artificial intelligence, where compute power is the new currency, Alset has the tools and expertise to serve as a pivotal contributor in driving the AI revolution forward. This mission aligns with the values of many potential investors, making Alset an attractive investment opportunity.

On the technology and assets side, Alset Capital has made strategic investments in Cedarcross International Technologies Inc. and Vertex AI Ventures Inc. These investments, backed by significant ownership interest, underscore Alset’s commitment to democratizing specific parts of the AI landscape. While Alset Capital has a diversified portfolio spanning various sectors, its AI-specific investment is the standout, representing its 49.0% ownership stake in Cedarcross International Technologies Inc. This strategic approach instills confidence in Alset’s investment decisions and its potential to deliver potentially significant investment returns.

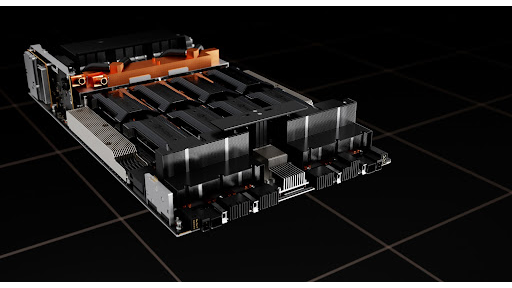

Cedarcross’s vision is to become one of Canada’s largest high-performance AI computing providers. Cedarcross’s mission is to democratize access to high-performance AI computing by offering access to the world’s fastest AI computing servers, heralding a new era of technological advancement. Last week, the company signed an agreement with an arm’s length counterparty to distribute 64 Nvidia H100 HGX 8GPU servers, generating $26 million in revenue and an expected $2.8 million gross profit for Cedarcross.

That deal may be the prelude to more. By offering access to the world’s fastest AI servers powered by Nvidia GPUs, Cedarcross empowers enterprises with high-performance computing capabilities exceeding 700,000 hours.

Leveraging Key Business Relationships

That’s just one revenue-generating relationship. Through its strategic hosting relationship with a leading North American data center provider, boasting an extensive network of over 40+ facilities across key markets, Cedarcross is also accruing value by ensuring clients seamless connectivity and reliability. This partnership fortifies Cedarcross’s infrastructure with essential features like fiber optic connectivity, UPS backup, and localized computing capabilities.

Cedarcross’s strategic approach to leasing compute resources to enterprise clients demonstrates a clear pathway to significant revenue growth. By facilitating the training of AI workloads, Cedarcross plans to generate cash flows and scale its hardware infrastructure fleet to meet evolving market demand for computing. Leveraging its industry-leading partners, Cedarcross is poised to drive streamlined growth and innovation in the AI sector.

Cedarcross’s AI computing hub of 5 initial Nvidia H100 HGX servers is fully installed and operating in a Tier 3 data center. Powered by the Nvidia HGX 100 GPU servers (each of which has 8 Nvidia H100 GPUs), Cedarcross boasts GPU infrastructure that, when fully delivered and installed, is expected to immediately start to generate USD ~$2 million per year, with associated anticipated yearly net cash inflows of $1.6 million.

Providing An Infrastructure, Not Just A Server

Cedarcross has the foresight and knowledge of the lead time and execution required to build AI computing hubs, extending beyond simply acquiring GPU servers. Over the last several months, Cedarcross has worked tirelessly to order, set up, and initiate this AI computing hub. Cedarcross has five Nvidia HGX H100 GPU servers delivered and installed, which are interconnected using the Infiniti brand network. Each server is linked to eight 400GB optical modules, ensuring optimal efficiency between the servers.

Well-fortified with its high-performance computing hardware, specifically Nvidia H100 HGX GPU servers, Cedarcross has positioned itself to revolutionize AI computing infrastructure. This is different from what many companies do, or better said, are trying to do in the sector. That’s potentially excellent news from a company and investor perspective. Remember, most of the market high-flyers are companies in the chip segment, the engines, if you will, to power and serve the demand from the thousands of companies competing for client and investors’ attention. While there are many facets to what they want and need, one thing remains constant: AI requires massive amounts of specialized computing power.

VERTEX AI VENTURES

Vertex AI Ventures, Alset’s other strategic investment, also focuses on identifying and acquiring intellectual property (IP) and providing data management services. In the realm of intellectual property (IP), Vertex AI Ventures is focused on the identification and acquisition of innovative AI IP from early-stage ventures. On the Data Management front, Vertex AI Ventures is a pioneer in providing top-tier data management services. By leveraging the power of artificial intelligence, the company offers innovative solutions designed to streamline operations, reduce operational and capital expenditures, and secure a competitive advantage in our increasingly data-centric world.

Capitalizing On Specialization

That’s in Cedarcross’s business wheelhouse. They provide turnkey, high-performance AI cloud computing hardware solutions to enterprise clients. That differentiation is more than good from a client services perspective; it presents a pure-play investment opportunity in high-level artificial intelligence and cloud computing technology.

Keep in mind that the demand for specialized computing power, particularly GPUs developed by Nvidia, actually helps expose the critical role Cedarcross plays in advancing segments of the AI space, primarily through leasing computing power to enterprise clients and then streamlining AI training models and agent development to expedite harnessing AI’s client-specific transformative potential.

There’s more to appreciate. Cedarcross’s ownership and operation of Nvidia H100 HGX GPU servers place it in a unique position within the AI computing landscape. Scarcity and high demand for such hardware often necessitate strategic partnerships and supply chain relationships, areas where Cedarcross excels. More than excel, the Cedarcross business model is profitable, with gross margins on leasing H100 server space estimated at approximately 80% contributing to a rapid payback on hardware investments. That keeps the company growing and, most importantly, well-positioned competitively.

Industry Veterans Lead With Sector-Specific Expertise

By the way, growth is no coincidence. Alset Capital Inc.’s leadership team is led by CEO Morgan Good and supported by seasoned professionals like Roger He. Its portfolio company, Vertex AI Ventures, is led by Niko Kontogiannis, who brings a wealth of experience in venture capital, finance, and technology sectors. Moreover, their collective vision aligns with industry trends highlighted by prominent figures who emphasize the pivotal role of computing power in shaping the future of technology.

In a recent interview, one of the sector’s leading thought leaders shared thoughts on the future of technology, emphasizing the significance of computing power by referring to “compute” as the “currency of the future” instead of fiat or cryptocurrency, adding to his belief that “compute” will become the most valuable commodity in the world, stressing the need for substantial investments to increase computing capabilities—not a small amount, either.

TRILLIONS in funding will be needed to compete with NVIDIA and TSMC in the semiconductor manufacturing industry. Here’s the critical thing to understand: Don’t consider those wanting a piece of the sector action as new competitors entering the market; it’s quite the opposite. The interest actually shows just how substantial Nvidia’s technological advantages are regarding AI computing hardware and the potential to seize opportunities where they aren’t directly focused. While it may take decades and trillions to catch up, it exposes how significant the opportunities are for companies to capitalize on and fill the service gaps.

Working To Maximize its Opportunities

Alset Capital certainly wants to earn its share. To accelerate that intention, it can utilize the capital raised from its completed and fully subscribed non-brokered private placements, deals that position it to advance strategic initiatives, and, as important in many respects, emphasize investor confidence in the company’s direction and ability to capitalize on and maximize its potential.

It’s often said in the investment world…follow the money. In this case, it may be wise to agree, recognizing that Alset Capital Inc. has an asset arsenal to capture its share of the burgeoning AI market by leveraging its investments in Cedarcross and Vertex AI Ventures. Both can drive innovation and unlock value for shareholders. And as AI continues to permeate various industries, Alset Capital’s role as a cutting-edge AI computing infrastructure facilitator, through at least two compelling assets, makes it investment-worthy.

Considering its global market listings, many get that chance.

Disclaimers and Disclosures:

This Disclaimer and Disclosure statement is a permanent part of this content. Any reproduction of this content that does not include the Disclaimer and Disclosure statement is unauthorized and strictly prohibited. All investments are subject to risk, which must be considered on an individual basis before making any investment decision. This paid advertisement includes a stock profile of Alset Capital Inc. This paid advertisement is intended solely for information and educational purposes and is not to be construed under any circumstances as an offer to sell or a solicitation of an offer to purchase any securities. In an effort to enhance public awareness, Shore Thing Media Group, Llc. was retained by Alset Capital, Inc. to create and distribute digital content for Alset Capital Inc.Alset Capital Inc. compensated Shore Thing Media Group, Llc., and/or, its parent company, USD one-hundred-fifty-thousand-dollars via wire transfer to complete and distribute these services. This advertisement is being disseminated for a period of one month beginning on 05/16/24 and ending on 06/18/24. Shore Thing Media Group, Llc. owners, officers, principals, affiliates, contributors, and/or related parties do not own, intend to own, sell, or intend to sell Alset Capital Inc. stock. However, it is prudent to expect that those hiring Shore Thing Media Group, Llc, including that company’s owners, employees, and affiliates may sell some or even all of the Alset Capital Inc. shares that they own, if any, during and/or after this engagement period. If successful, this advertisement will increase investor and market awareness of Alset Capital Inc. and its securities, which may result in an increased number of shareholders owning and trading the securities, increased trading volume, and possibly an increase in share price, which may be temporary. This advertisement does not purport to provide a complete analysis of Alset Capital Inc. or its financial position. The agency providing this content are not, and do not purport to be, broker-dealers or registered investment advisors. This advertisement is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a registered broker-dealer or registered investment advisor or, at a minimum, doing your own research if you do not utilize an investment professional to make decisions on what securities to buy and sell, and only after reviewing the financial statements and other pertinent publicly-available information about Alset Capital Inc. Further, readers are specifically urged to read and carefully consider the Risk Factors identified and discussed in Alset Capital Inc. SEC filings. Investing in microcap securities such as Alset Capital Inc. is speculative and carries a high degree of risk. Past performance does not guarantee future results. This advertisement is based exclusively on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, Shore Thing Media Group, Llc. cannot guarantee the accuracy or completeness of the information and are not responsible for any errors or omissions. This advertisement contains forward-looking statements, including statements regarding expected continual growth of Alset Capital Inc. and/or its industry. Shore Thing Media Group, Llc. note that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect Alset Capital Inc. actual results of operations. Factors that could cause actual results to vary include the size and growth of the market for Alset Capital Inc. products and/or services, the company’s ability to fund its capital requirements in the near term and long term, federal and state regulatory issues, pricing pressures, etc. All trademarks used in this advertisement are the property of their respective trademark holders and no endorsement by such owners of the contents of this advertisement is made or implied. Shore Thing Media Group, Llc. are not affiliated, connected, or associated with, and are not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made to any rights in any third-party trademarks. Additional disclosures and disclosures can be found at https://primetimeprofiles.com/disclaimer/.