SOBR Safe, Inc. (NASDAQ: SOBR) is proving that excellent investment opportunities can come with a small price tag. While its $1.77 share price may keep it under the radar to many, this NASDAQ-traded company is bringing to market the most revolutionary alcohol screening technology in decades. It’s reliable, non-invasive, quick, and goes a significant step further than any other screen with its ability to record, transmit, and produce comprehensive reports to management, insurance providers, and law enforcement.

Still, while the story may be new to investors, SOBR technology is already making its way to Main Street. Several major companies are committing to implement the SOBRcheck technology, including prominent product development and manufacturing firm BGM Electronic Services, Inc. That deal is significant in two ways. First, the business from BGM alone can be worth millions. Secondly, and perhaps the most exciting part of the deal for SOBR and its investors, is that it could facilitate sales with several of the largest automakers in the world through already established relationships with BGM.

There’s plenty more to like. Last week, SOBR announced signing a software as a service (SaaS) agreement with a prominent Native American tribe, a Self-Governing Nation in the United States serving thousands of members. The deal calls for initially implementing the SOBRcheck™ technology to ensure its transit fleet is 100% alcohol-free. If SOBR delivers the results as intended, with existing efficacy data indicating no reason to expect otherwise, that deal could lead to additional implementations across other critical, safety-sensitive functions. In other words, like the deal with BGM, this one also puts millions in play.

Moreover, it’s another foot in the door to a lucrative opportunity. This first engagement could help expedite business from among the 574 sovereign tribal nations in the United States. Still, this newest deal is just the tip of the SOBR value proposition. SOBR has inked other deals to expedite penetrating revenue-generating opportunities in the manufacturing and telematics markets.

Modeling those opportunities into the valuation equation and recognizing the current, near, and long-term marketability for its award-winning, game-changing, and innovative SOBRcheck™ technology, it’s not overly optimistic to believe SOBR is well positioned to soon begin posting significantly higher share prices based on revenue multiples alone.

SOBRcheck Is Best-In-Class Alcohol Screening Technology

There are several reasons supporting that presumption. The biggest is that SOBR will likely score additional big-name deals after earning major industry accolades, including Occupational Health & Safety 2022 New Product of the Year and Child Safety Networks Safe Family Seal of approval for Safety Monitoring Devices. That recognition sets up SOBR for financial rewards, considering those accolades add credibility that can fuel product adoption in multiple markets faster than expected. That demand can come not only from private sector demand but also from legislation written more proactively than ever to protect businesses, schools, and highways from incidents and catastrophes related to over-the-limit alcohol consumption.

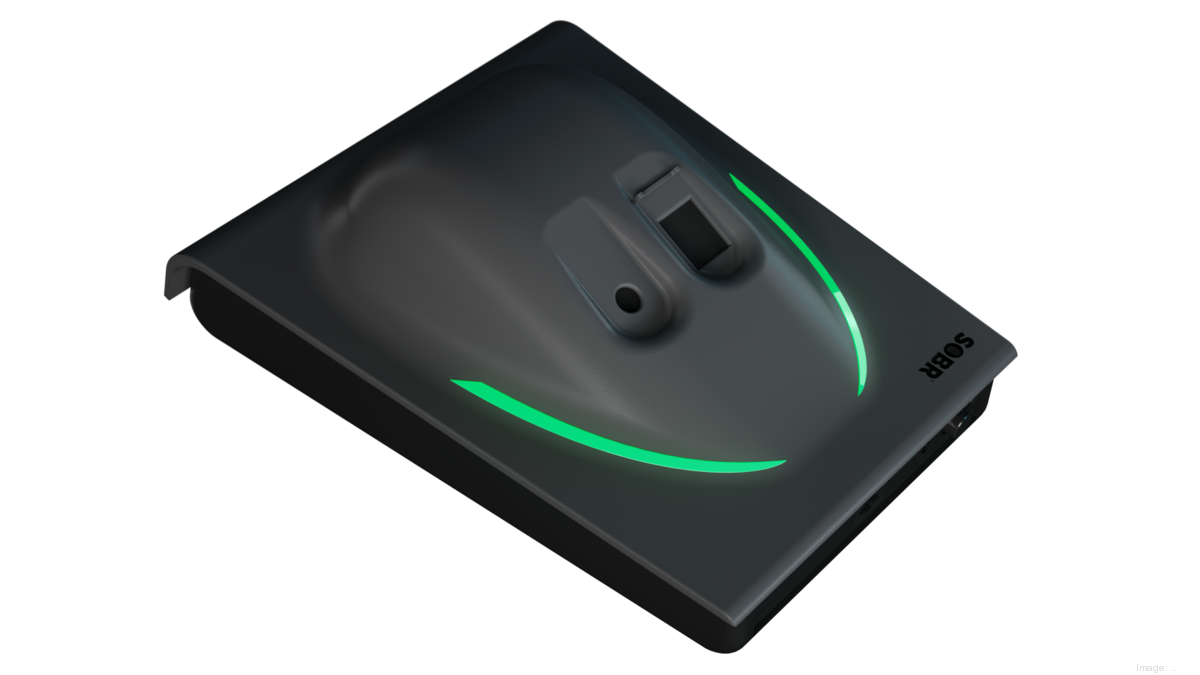

Combined, they are helping accelerate SOBR’s mission of becoming a bigger company faster. But industry recognition isn’t the primary value driver; developing innovative best-in-class alcohol screening technology is. The better news is that SOBR’s technology definitely isn’t more of the same. Unlike other detection systems, SOBRcheck measures alcohol presence through finger touch technology, requiring no breath test or blood draw. Allowing clients to start screening on the fly, SOBRcheck is easy to integrate into a company’s cyber infrastructure, one of its most attractive features driving client interest.

But the more critical consideration driving SOBRcheck adoption is that the device and platform effectively screen drivers for alcohol use via its IP-protected, fast-acting, finger-touch technology. Often implemented at facility entry points, workers place a fingertip or palm on a device that generates a reading within 20 seconds. If the test detects alcohol, a report is generated, and that employee gets immediately flagged and likely won’t get keys to a vehicle, whether an 18-wheel truck or a forklift. Clients appreciate that proactive money-saving benefit which, unlike most of its competitors, does not subject their workers to an invasive breath or blood screening.

Beyond being a front-door deterrent, the SOBRcheck platform does more than measure alcohol volume; it reports, aggregates, and interfaces client infrastructures by connecting resources to resources with real-time reporting. SOBR believes that advantage can forever change how companies monitor for zero-tolerance compliance.

A Better And More Accurate Option

Of course, the platform must be accurate, especially with life and livelihoods at stake. SOBRcheck checks that box, scoring an accuracy rate of 94% compared to low to mid 80% for current commercial breathalyzer technology. As mentioned, it’s also innovative, analyzing the natural humidity and vapor of the skin, a departure from the most commonly used alcohol detection methods requiring breath, saliva, or blood. What’s more, its uses can scale.

SOBR offers additional detection devices, including the SOBRsure™ wristband, which utilizes the same touch technology but as a wearable device. This feature provides a considerable competitive advantage because it allows for initial and ongoing employee management. But know that companies don’t use SOBRsafe to micromanage employees; they only want to do the right thing: keep intoxicated drivers off the highways and equipment.

If using SOBRcheck results in a single life saved at a company, its value extends for generations. Considering its applications can be used for DUI management, school bus companies, ride-share companies, and last-mile fleet businesses, that’s a likely and welcomed outcome.

Signing Deals Leading To Expedited Growth

Two recent announcements prove that the majors are paying attention. In February, SOBR announced that product development and manufacturing firm BGM Electronic Services, Inc. is implementing SOBRcheck™ as its new front-line alcohol screening solution. As noted, that agreement expedites SOBR’s entry into the $4 billion U.S. manufacturing market.

Moreover, the most significant inherent benefit is that it could fast-track new relationships with major auto manufacturers, including BGM clients Ford (NYSE: F), GM (NYSE: GM), and Stellantis (NYSE: STLA) (Chrysler-Fiat). Remember, even if through BGM, the revenue-generating opportunity can be substantial. During the height of the COVID pandemic, General Motors contracted BGM for the GM/Ventec/U.S. Government Ventilator Project, successfully delivering 390,000 electronic assemblies for 30,000 ventilators in just 150 days.

This achievement didn’t go unrecognized. GM designated BGM as its 2020 Supplier of the Year – Over Drive Achievement Award. That validation could help expand its platform’s presence sooner than later and could quickly put business from logistics and defense manufacturing powerhouses like United Parcel Service (NYSE: UPS), FedEx (NYSE: FDX), and Lockheed Martin (NYSE: LMT), in SOBR’s crosshairs. Again, either directly related or through a third party, SOBR is a winner.

Leveraging Expertise And An Aggressive NTSB

The company hired Chris Burton as Director of Commercial Development to accelerate reaching that goal. Bringing over 15 years of enterprise technology sales success, Burton is well-connected to expedite the introduction of SOBRsafe to the $8 billion U.S. telematics market through established industry relationships, including original equipment manufacturers (OEMs) Daimler, Freightliner, Continental, and Thomas Built Buses. Telematics is the “brain” inside a vehicle that provides real-time, remote reporting on driver behavior, performance, and fitness for duty.

But here’s the wild card that SOBR holds: the National Transportation Safety Board (NTSB) wants the most effective technology to screen for alcohol implemented as quickly as possible. NTSB Chair Jennifer Homendy has not minced words about the urgency in making the agency’s plan the law, recently saying, “We need to implement the technologies we have right here, right now, to save lives.” People should and probably are letting her know that through SOBR, practical measures of protecting the roads, workplaces, and people on and in them are available. So, why is her statement timely to SOBR and its investors?

Because SOBRsafe’s passive alcohol detection platform, SOBRcheck™, can already meet, integrate, and expedite embedding the objectives the NTSB refers to. In fact, with deals to ensure driver safety for companies like Continental Services and its 1,800 employees across four states, they already are. By providing an effective solution to proactively manage alcohol policy while complementing existing safe operations, SOBR can benefit nearly any industry.

Another fact to keep in mind is that the NTSB wants drug and alcohol screening mandates met by 2025. Thus, a tsunami of business could be headed SOBR’s way.

A Diversified Placement Strategy

That business won’t only come from companies managing highway and industrial vehicles. Partner company Butterfield Onsite Drug Testing is broadening SOBR’s reach into the airline industry by building a SOBRsafe sales team to represent the company to a potentially global audience. Additional working partnerships expand company coverage.

SOBR established a distribution deal with the public benefit corporation Reconnect, which aims to renovate outdated substance management systems. The SOBRsafe platform provides a centralized space for participants within the justice space to digitally record data and access management systems. Similar deals with North-Star Care, Continental Services, and RecoveryTrek also help members regulate test results, expanding SOBR’s reach further. That’s not all.

SOBR’s partnership with the ride-share app RubiRides is another example of a practical solution to dangerous potential and liability. RubiRides specializes in trustworthy transportation for kids creating a need for drivers to be reliably tested. Meeting that challenge, SOBRcheck™ wristbands are the perfect tool since they continually monitor alcohol-free safety, upload data to the cloud in real-time, and ensure sober driving.

The same wristband technology applied to school bus drivers should happen without delay, and as voices get louder, expect that to happen. Needless to say, the revenue-generating potential from that market opportunity could reach the billion-dollar-plus level.

Ground-Floor Valuation Exposes Opportunity

Thus, when it comes to investing, there are investment opportunities, and then there are ground-floor investment opportunities. SOBR is the latter, and off of its YTD highs, the company is better positioned today to accelerate revenue growth than at any time in its history. Remember, SOBR isn’t a conceptual stage company; they have a marketable product that has earned the OSHA New Product of the Year award and the Child Safety Networks Safe Family Seal of Approval for safety monitoring devices. Those accolades don’t come easy.

Still, the most prominent measure supporting the bullish thesis is that SOBR isn’t a wait-and-see situation. They already have marketable products, technology, and management expertise delivering value to their clients. As that continues, updated revenue models should support a trajectory to reclaim its 52-week high of $9.57, roughly 440% higher than the current. If so, SOBR presents a case where everyone involved can win, from pedestrians to investors and every company and agency in between.

Disclaimers: Shore Thing Media, LLC. (STM, Llc.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to ten-thousand-dollars cash via wire transfer to produce and syndicate content for SOBRsafe, Inc. for a period of one month ending on 4/30/23. Please read the full disclaimer at https://primetimeprofiles.com/

As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website.

The Private Securities Litigation Reform Act of 1995 provides investors a safe harbor in regard to forward-looking statements. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions or future events or performance are not statements of historical fact may be forward looking statements. Forward looking statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward looking statements in this action may be identified through use of words such as projects, foresee, expects, will, anticipates, estimates, believes, understands, or that by statements indicating certain actions & quote; may, could, or might occur. Understand there is no guarantee past performance will be indicative of future results. Investing in micro-cap and growth securities is highly speculative and carries an extremely high degree of risk. It is possible that an investors investment may be lost or impaired due to the speculative nature of the companies profiled.